Annual Obligations

CORPORATE OBLIGATIONS

The company has once-a-calendar year reporting obligations and it is important that it stays up to date. Annual filing obligations include:

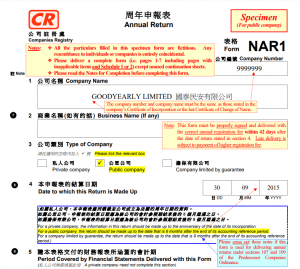

1. Inform the Business Registry

Filing an annual return FORM NAR1 with the Companies Registry each year on the company's anniversary date. To keep the registry informed about name, share capital, address, directors, shareholders. It must be submitted on the anniversary date.

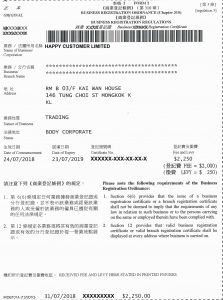

2. Renew the Registration Certificate

Renew the Registration Certificate (Bussines Registration Certificate – BRC) with the Inland Revenue Department – IRD.

3. Hold Annual Assembly

Hold an Annual General Meeting (AGM – Annual General Meeting) within 18 months from the date of incorporation. At AGMs it is a review of the annual balance sheet and a management review. It does not have to be in person, it is held remotely.

4. Tax Return

The submission of the BIR51 income tax return to the Inland Revenue Department (IRD) for each year. The filing date depends on the closing of the company's financial year.

5. Report Changes to the Business Registry

The company must inform the Companies Registry of certain changes in the company as soon as they occur. This includes the obligation to report changes in directors, shareholders, secretary, registered address, share capital, changes in shareholder or director data (including passports), normally within 15 days, under threat of sanctions.

FEE

CORPORATE

Registrations and Assemblies-

Annual Assembly

-

BRC Renewal

-

Update before CR

ACCOUNTING

Fiscal Year Accounting Plan-

Annual Accounting Plan

-

By fiscal year

-

In accordance with HK regulations